My name is Don, and I am a debtaholic. Hi, Don.

I started using debt as soon as it became available to me. I bought my first car at 16 years of age with debt. My parents co-signed the loan for me.

It wasn’t that big of a deal. I was working part time after school and my earnings were ample enough to afford the payments, insurance, and maintenance on the vehicle. So, what was the harm in that?

Then, I decided I needed to buy into a lifetime fitness membership with a local club. I signed a two year term loan to get it.

By this time, I had a couple credit cards I was using to purchase all the “stuff” I wanted, but couldn’t really afford. I could afford the additional monthly payments, though. That was all I needed to worry about.

Then I got married. That has costs tied to it. I had a credit card for that.

We needed bigger cars. There were kids on the way, and we had more household expenses. Life got more and more expensive. I bought more and more lifestyle with my credit cards.

Fast forward about 25 years to my early 50’s where I could barely keep up with all the minimum payments on my debt. I was shuffling money from credit card to credit card to stay current on the payments. Can you believe that? I was using credit to pay my debts. I knew that was a huge problem, but by now, my life cost much more than my income, and my choices had become very limited.

I was fully aware exactly how much debt I had, and it was painfully clear to me how much I was paying out each month to stay current. I just didn’t like to think about it much. I tended to push it to the back of my mind. I was a proud person and having this much debt was embarrassing to me.

I allowed myself to believe that debt was normal. Everyone has debt. It’s a fact of life.

But, debt was killing me. It caused so much stress in my life and my marriage. It was even draining me, spiritually. I had stopped tithing because I needed that money to make payments on debt. Talk about a self-imposed burden of guilt. I was completely shackled.

Time to Evaluate My Debt

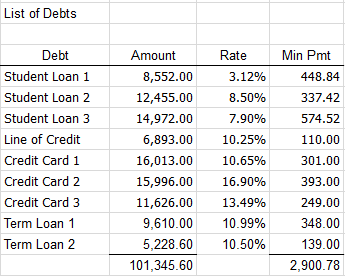

It made me a little uncomfortable when I finally wrote down all of my debts and began to evaluate my situation. Here’s what I found.

I was horrified to realize that I was paying out almost $3,000 every month to creditors. Imagine what I could do with that extra $3,000 if I wasn’t paying it all to the banks. This didn’t even include our house, which was costing us another $2,000 in payments and maintenance.

I was making plenty of money to live a really good life. For some reason, it never seemed to be enough.

Going through this little exercise turned my financial life around. We began to plan for how we could eliminate this problem. We put together a debt snowball plan to eliminate our debt. Then we created a budget, reduced our expenses, and began to live within our means so we could put more of our income toward paying off debt.

Living the Good Life

Two and a half years later, we are still working out our debt elimination. We have made significant progress, but have a ways to go. We sold our money pit of a house and have significantly downsized. We no longer spend money we don’t have. We pay extra money toward our debt every month. We’re watching our debt decline every month while our net worth has been growing.

Last year was very difficult, in that we had several significant medical expenses that came up. We clobbered those expenses like we never would have before. Though it slowed our debt elimination progress a little, we never felt overwhelmed. Two years earlier, and those expenses would have bankrupt us.

Please take a moment to make a list of your debts. Think about how things could be different for you if you didn’t have to make these payments every month. Then, make a plan to change it. Since you have the list, you can easily plug the data into a debt snowball spreadsheet and begin working on eliminating the debt.