This is my first Net Worth update. I decided I would share my net worth each month. I’m doing this for two reasons:

- Transparency – I hope it lends credibility to everything that I share with you on this website. I’ve shared the importance of knowing your numbers and where you stand in this regard. I want you to see that it is a tool that I use regularly, and how it is impacting my personal situation.

- Accountability – It keeps me focused on my ultimate plans to grow my net worth to an amount that will allow me to live comfortably in retirement.

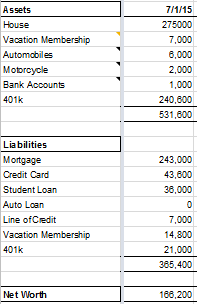

I like to look back to July 1, 2015 as a baseline for comparison. That is when I was first beginning to get serious about getting my debt problems under control and when I realized that my prospects for retirement looked pretty bleak.

Here’s where we stood at that time (the screenshot is directly from my tracking spreadsheet in Google Docs):

Note that I wasn’t calculating my Net Worth at that time, but have looked back and estimated as closely as my records allow me to. I’m certain that it’s a very close and realistic estimate.

As you can see, we weren’t in horrible shape, but for my age, it certainly wasn’t good. We were 54 and 51 at the time. We had a positive net worth number, but not nearly positive enough considering how close to retirement we were.

Our home and our 401k were the primary assets and our home was basically owned by the bank.

Shortly after that baseline month, we sold our house, along with about half of our earthly possessions, and began aggressively paying off debt. Since that point in time, we have been paying off debt and at the same time, have increased the amounts that we are putting into my 401k and other savings.

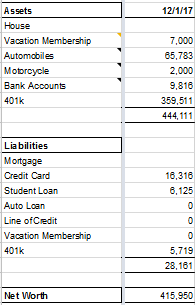

Here’s how things stand as of the end of November 2017:

During those two and a half short years, we made significant progress IMHO. We focused on paying down debt and the market has been pretty good for the funds in my 401k. I’ve also added a fair amount into my 401k.

You’ll notice that there is a significant increase to automobiles in the asset category. Please notice that there is no corresponding debt in auto loans. I didn’t go out and buy a fancy new car. That would be dumb. We were gifted a cool old car that we have in our garage, now, and I’m listing it as an asset at the appraised value. All other automobiles are listed at the kbb.com private party value.

The vacation membership is a timeshare that we use extensively. It’s an asset that we intend to keep. We paid way too much for the membership, but now that we own it, we feel the benefits measure up to the cost of maintenance of the account.

The bank accounts are the only assets we have that are immediately liquid. I’m confident that if it became necessary, we could sell the other assets (not including the 401k, of course) at the values listed. I’m not old enough, yet, to get into the 401k without incurring penalties.

How do I Feel About Our Net Worth Position?

We’re far from our retirement goal, and have far too little time to reach our goal.

I’m proud of the progress we’ve made recently, but embarrassed about the time and money we wasted up to that point. We lived to long without discipline and without following a plan.

We are counting on good health and continued success in our jobs so we can keep progressing toward our financial goals. Continued stock market increases would go a long way toward getting us retirement ready, but we can’t count on the market’s cooperation.

At this point, I’m mentally prepared to work past normal retirement age, and/or possibly take on some type of part time gig to supplement our endeavors.

There is light at the end of the tunnel.