This is the time of the year that many people are looking ahead to the new year. They are setting their 2018 goals, their New Year’s Resolutions.

This past Sunday, my pastor challenged us to not make resolutions, but instead to find resolution.

What I’m going to do in this post is to take a look back at 2017 to review some of my successes, but even more so, the areas where I feel that there is room for great improvement, and find a resolution to many of my life’s situations throughout this coming new year.

What Happened in 2017

Personal Financial – I have a lot to work on, but I have a good base to start with. As you can see in my previous post, my net worth is now over $400,000. That’s an increase of more than $170,000 through 2017. Wow! I have to be happy with that. Of course, about $60,000 of that was a gift from a relative, and not something that I can call an accomplishment. Still, I’m doing my happy dance as I write this.

Much of that increase is the result of a great year for equity investments. My 401k is invested heavily in stocks, and they did very well. Throughout the year, I contributed about $8,250 and my employer matched that. Additionally, I paid back about $6,600 on a loan I took out against my 401k several years ago.

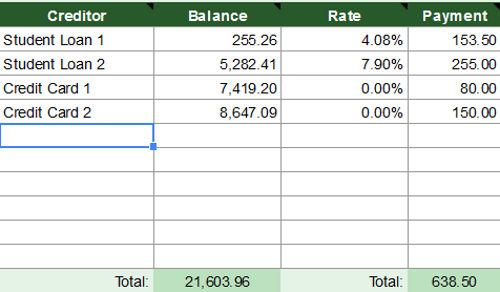

Aside from my credit card that I use on a daily basis and the 401k loan mentioned in the previous paragraph, I still have about $21,000 in debt that I’m working to pay off. This table shows what I have left to pay.

It’s down from about $39,000 a year earlier, so I paid off almost $17,500 over the course of the year. I’m disappointed with that, but have to keep in mind that I also paid several thousand dollars out of pocket toward medical expenses for my wife and I. Additional, we lost a few thousand $$’s as a result of my wife missing a few weeks of work due to problems with significant back pain. Had we been able to convert those costs to debt pay down, this table could be showing us as owing less than $10,000 in remaining debt.

Those medical costs were a little bit of a shock to our system. We had only paid out about $500 per year in each of the previous four years. I’m so thankful that we had been working to pay down our debt and making much better decisions with our money over the past two years. If we hadn’t been working so hard to cure our financial woes, these medical issues could have forced us into a really bad place in regard to our personal finances (foreclosure, bankruptcy…who knows).

Health – My health is generally pretty good. Until I had my knee surgery in November, I was walking one to three miles almost every day. I was also playing pickleball about once per week. During the spring and summer months, I’ve gotten in a little hiking in the mountains.

My good cholesterol is very low and my bad cholesterol is a little high. My triglycerides are high. My BMI is at the high end of normal, though if you saw me, you would consider me as thin.

I haven’t been following any specific diet plan, but I eat balanced meals. I avoid sugar, white flour, and carbonated drinks. I’m taking glucosamine supplements for my joints and fish oil to help with my cholesterol. I drink lots of fluids, including water, orange juice, apple juice, green tea, and a little coffee – probably close to 64 ounces or more in total fluids per day.

Spiritual – A few months ago, I started a program for reading the bible through in a year. I chose a program that goes through in a chronological order. I find that it reads more like a story and is easier to follow.

Our church attendance is very regular. We rarely ever miss a Sunday service. We attend a great church with a mission towards serving our community.

I believe that serving in and for the church is a fundamental part of a Christian’s life. At the church I attend, I’m ushering at least one Sunday per month. My wife, daughter, and I are serving coffee drinks in the church’s cafe once per month. I teach a fifth and sixth grade boys class every week. I help cook the Wednesday night meal once per month. My wife and I acted as coordinators for the Financial Peace University class that our church held in the Fall.

Another important part of a Christian’s service is their giving. I’m happy that we are able to give more than the usual tithe of one tenth of our earnings. I must admit that it was only a couple years ago that we were unable to give much, if anything. We were in bad shape. Things are better now. Debt really affects every part of your life.

Business – Debt or a Life – I purchased the domain, and starting setting up the website in the early summer of this year. It was pretty slow going at first. I published my first blog post on this site in mid-October of this year. I didn’t make the site visible to Google until a month or more later – after I had several more posts published.

I’ve added about 3 posts per month, since then. I really need to be more active. It’s easy for me to read and learn. The topic is at the forefront of my mind, all the time. I don’t know if it’s laziness, or writer’s block, or what, but it’s so much harder for me to sit down and put pen to paper.

I tend to work better when I have deadlines. Maybe the answer for me to accomplish more is to self-impose some deadlines.

What I Plan to Resolve in 2018

So, I’ve set a few 2018 goals that I believe will resolve some of the things about my life that I’m not satisfied with.

Personal Financial – Since my employer has decided to make their matching contributions in our 401k and retirement account discretionary, I can’t count on that any longer. I can only count on the part that I invest. I’m currently adding about $1,500 per month, with about $550 of that going toward pay down on the 401k loan. My plan is to maintain my total contributions to a level of $1,500 per month by the end of the year, even though the loan will be paid off in October of 2018. By doing this I will have resolved the issue of having that nasty 401k loan hanging over my head and I will have continued investing at a good, steady pace even though I’m no longer receiving the employer matching contributions.

I will resolve all of my debt issues by eliminating the total debt from the table above.

I’m not riding my motorcycle much anymore, so I’m going to sell it, for whatever I can get for it. The proceeds will go toward debt pay down, and it will lower my expenses by eliminating the insurance and license costs of about $150 per year. Not only that, but I’ll have room for two cars in the garage.

Health – I am committing myself to getting my cholesterol to satisfactory levels. Besides helping me to live longer and feel better, this will make it possible for me to earn all the rebates that my employer will pay into my HSA for meeting the established health goals.

To meet that goal, my wife and I are going to eat healthier meals and we are adding some supplements that are supposed to help regulate cholesterol, metabolism, etc.

Spiritual – My bible reading has really expanded and become a routine for me. My prayer life – not so much. I’ve started a new devotional that will help me get on a regular prayer routine. I am adding this new devotional time and a prayer time to the morning bible reading time each morning before work. I’m also checking out some phone apps that should help me keep a detailed prayer list to remind me of all that I need and want to pray for/about.

Business – Debt or a Life – My activity on this blog has been utterly pitiful. I am going to increase my activity so that I’m adding at least two blog posts per week. That way, I’ll have more than 50 new posts by the end of 2018.

I started working on a “Start Here” page. I have a lot of work left to do on that page, but would like to have it active before the end of February. That will include some beautifying of my blog.

I have a personal Pinterest page, but I want to start a new business page specifically for Debt or a Life. I’ll start with about 10 appropriate boards and at least 5 pins per board. Then, I will make sure that each of my blog posts are optimized with photos and pinned to my new Pinterest account.

A little later this year, after I start growing my traffic, I would like to set up a Facebook Group. I don’t want to take on too much too soon and end up with unsatisfactory results or ending up in burnout.

There, It’s Out!

I’ve bared my soul to you. Keep me accountable.

If I stick with these commitments, I’ll be in a much better place by the end of the year (not that life is so bad at present).