So, here it is, once again. I’m laying it all out there for you. It’s time for my monthly Net Worth Update.

As much as I try to post articles that I believe will be beneficial to my readers, This one is actually as much for me as it is for you. It’s a way for me to be accountable in my efforts to grow my net worth and to keep my focus on my plan.

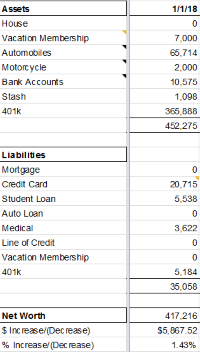

Though I have recreated close estimates from a couple years ago, I really just started last month to monitor my net worth. Compared to what I have heard and read about national median savings rates, I’m surprised that I’m as high as I am. My net worth is way more than the median national savings rate for my age. A calculator that I used to find out where I stand puts me in about the 70 percentile for my age. Three years ago, I was below the median. You gotta be happy with the improvement, right?

I noticed that I had missed a credit card, last month, so I was off by about $5,000. It’s the card I use every day, but pay the balance in full when it becomes due. It’s offset by cash in the bank, since I hold funds as I purchase with the card. That way, I always have enough to pay the card off when it’s due.

Also, this month, I added some medical bills that I owe. I recently had a surgery on my knee, and the bills are coming in fast and furiously. It may take me a couple months to get them all paid. I hope the doctors and hospitals are understanding and don’t hit me with interest charges before I get them all taken care of.

My net worth increase is primarily related to the growth in my 401k. I’ve been putting in about $1,300 per month and my company has been adding about $700 on top of my contributions. That means that more than half of the increase was due to the great performance of my investments. It’s been a great year to have money in equities.

Unfortunately, my employer just announced that they will be withholding their matching 401k contributions and from here on out, will only share those with us if the company meets certain profitability thresholds. That means we can’t count on receiving those funds. That’s going to put a huge wrench in my retirement plans. I may have to start moonlighting to cover the deficit.

I don’t blame anyone but myself for the situation I’m in. I’m the one who mishandled my money for so many years. Yet, at the same time, it could be much worse.